GST Suvidha Center - Franchisee

ACEGST is a licensed GST Suvidha Provider from registered (GSP) in India. We can help you to open an Authorized GST Suvidha Kendra in your location anywhere in India approved by GSP provider.

Services Related :

- GST Registration

- All types of GST Return Filing

- GST Consultation

- ITR Filing and Auditing

- Digital Signature Certificate (DSC)

- Accounting and Book-Keeping

- GST queries & Support.

ACEGST facilitates in setting up GST Suvidha & Accounting Centers whereby business owners can come and file their GST returns & maintain their accounts.

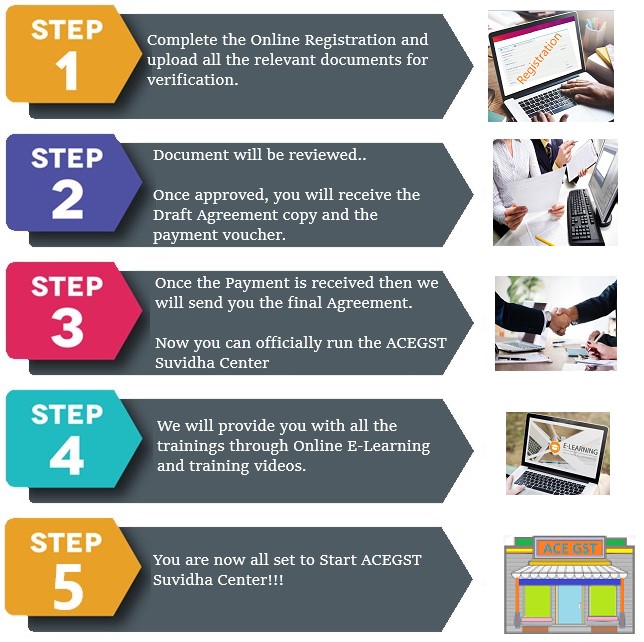

GST Suvidha Centre Registration Process

WHO MAY APPLY

- GSK Operator should be a Graduate

- Should have basic knowledge of Accounting

- Should have good knowledge of Computers

Basic Requirement for Setting up GST Suvidha Center

- Should have an Office space of at least 100 sq. ft.

- Should be able to employ at least 2 people (1 Data Entry Operator and 1 Accountant)

- Should have basic IT Infrastructure needed for GSK (2 Computers, 1 Printer, 2 Mbps Broadband connection)

BENEFITS

- Setup Business in your town at nominal charges

- Help Businesses file for GST Returns

- Enjoy Unlimited Returns and GSTINs

- Training given by Certified GST Trainers

- Local support with State Level Coordinators

- Highly Effective sales support

- Fast and simple setup

Suvidha Kendra Back Office Support

Don't worry!!! We are here to Help... Never Say "NO" to your Customer.

If you are not aware on "How to take GST Registration?" and "How to file GST returns?"

In that case, ask your customer to provide all the relevant documents as stated, You should verify the documents and scan the documents and then upload via our portal to our back office support team and Our team will do the necessary within the SLA (Service Line Agreement).

All these comes with a Nominal Fee.